Methods to Give

Every gift to HACC, Central Pennsylvania’s Community College, and the HACC Foundation helps HACC students, their families and our community. There are so many ways to help. For example, you may be interested in a one-time annual monetary gift, a major gift to name a space or a legacy gift. In particular, please consider recurring gifts, which are contributions you can make on a regular basis (for example, weekly, monthly, quarterly and annually).

- Recurring gifts are convenient, because you do not have to remember to make them. You can “set them and forget them.”

- Also, recurring gifts are flexible. You can change the frequency of your gifts whenever you like. For example, you can contribute on a weekly basis and then change it to monthly if you find that frequency to be more appropriate for you.

- In addition, recurring gifts allow you to make significant contributions without adversely impacting your other financial obligations. For example, if you want to contribute $1,000 but cannot afford to do so at once, you can contribute $83.33 per month for 12 months.

No matter how you choose to donate, we are grateful. No gift is too small, and each gift will make a meaningful difference in our students’ lives.

Please scroll all the way down this webpage to see the variety of online forms that were created with you in mind. These forms are effective, efficient and easy to use. If you have any questions or need additional information, please let us know at foundation@hacc.edu.

Thank you!

Please donate through our secure and easy-to-use online form.

Please complete a monetary contribution form, make your check payable to the HACC Foundation and mail them to:

HACC, Central Pennsylvania’s Community College

Office of Finance

One HACC Drive

Harrisburg, PA 17110

Please do NOT mail cash.

Most banks offer a bill payment system that you can use to contribute to the HACC Foundation. Your bank will automatically mail a check to the HACC Foundation once or on a regular basis (weekly, monthly or annually) after you enter the contribution amount, frequency and HACC Foundation's mailing address. This option is quick, convenient and typically free. Please provide the following contact information to your bank:

HACC, Central Pennsylvania’s Community College

Office of Finance

One HACC Drive

Harrisburg, PA 17110

717-780-2321

The HACC Foundation’s sponsorship opportunities give you more options to fit your needs. Sponsorships benefit HACC students, programs and the College's critical needs. Please consider becoming a sponsor for one of our events. Detailed information is available at www.hacc.edu/sponsorships.

Did you know many employers will match your charitable donations to HACC? YOU may be able to direct your employer to give to a cause you care about by applying for matching gift funds.

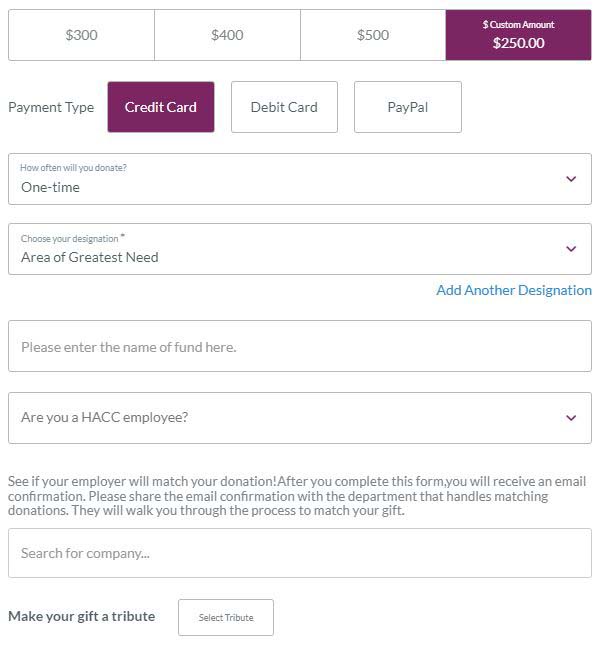

Please see if your employer will match your donation by visiting www.hacc.edu/givenow and entering your employer into the matching gift field. Please see the image below.

If your employer is listed, please:

- Ask your human resources department about your company’s matching gift policy and request the process you should follow to get your gift matched

- Follow the process

- Let us know if you have any questions: foundation@hacc.edu

If your employer is NOT listed but has a matching gift policy, please:

- Ask your human resources department about your company’s matching gift policy and request the process you should follow to get your gift matched

- Follow the process

- Let us know if you have any questions: foundation@hacc.edu

If your employer is NOT listed and does NOT have a matching gift policy, please:

- Give online at www.hacc.edu/givenow or complete a contribution form (pdf) and mail it, along with your check, to:

HACC, Central Pennsylvania’s Community College

Office of Finance

One HACC Drive

Harrisburg, PA 17110

- Make your check payable to the HACC Foundation

- Let us know if you have any questions: foundation@hacc.edu

Thank you!

Have you contributed to a donor-advised fund (DAF) to allow you to manage your charitable contributions from one account? You can make a gift from your DAF to the HACC Foundation to support HACC, Central Pennsylvania's Community College. Please contact your DAF advisor to direct your contribution to:

HACC, Central Pennsylvania’s Community College

Office of Finance

One HACC Drive

Harrisburg, PA 17110

You should receive acknowledgement letters – for tax purposes – from your DAF advisor when you contribute to your fund. Therefore, when the HACC Foundation receives contributions from your DAF, you will receive letters of gratitude from the HACC Foundation.

Is appreciated stock a part of your gift portfolio? Please consider the potential tax benefits of donating your long-term appreciated stock to the HACC Foundation. Appreciated stocks or securities are investments that have increased in value from the time they were purchased.

Appreciated stock has the potential to be a more efficient tax benefit than cash gifts by helping you to reduce capital gains taxes.

Generous individuals have donated works of art, books, equipment and other gifts of personal property to the College, depending, of course, on whether there is need for such items. If the College chooses to accept an item, the item's appraised value will be your tax deduction. Please complete and submit this form to donate your items.

Charitable gift planning allows you to support causes that matter to you – into the future.

To learn how you can leave a legacy at HACC and support HACC students, please visit www.hacc.edu/PlannedGiving.

Thank you!

You can designate the HACC Foundation as a beneficiary of a portion of your retirement funds. If you decide to make such a generous gift, be sure to list the HACC Foundation with the administrator or person in charge of your IRA, profit-sharing account or other retirement plan. We value all contributions greatly.

HACC employees have the unique opportunity to contribute funds that directly impact students and programs at HACC through payroll deduction! Your support will continue to provide opportunities for our students to earn a top-quality education using the best available technology and equipment.

Potential Tax and Income Benefits of Giving

Donors to the HACC Foundation may experience tax and income benefits. For example:

- Charitable deductions could provide an income savings for the value of the gift dependent on the donor's tax rate.

- Donors may reduce capital gains on securities and/or property gifts.

- Federal estate tax is eliminated on the value of a gift made via a will or revocable trust.

Please note that this information is tentative and subject to change and that all circumstances are different. This information is not intended or written to be used, and cannot be used, for purposes of avoiding tax penalties that may be imposed on any taxpayer. Please consult your attorney or financial advisor for more information.

Forms

Bequest Commitment Form

Data Request Form

Donor Recognition Form

Monetary Contribution and Pledge Form

Naming Opportunities Agreement Form

Non-Monetary Contribution Form

Payroll Deduction Form

Pledge Change Form

Pledge Reallocation Form

Scholarship Allocations Form

Scholarship Interest and Commitment Form

Sponsorship Commitment Form

Stock Contribution Form

Your Gift at Work Survey Form